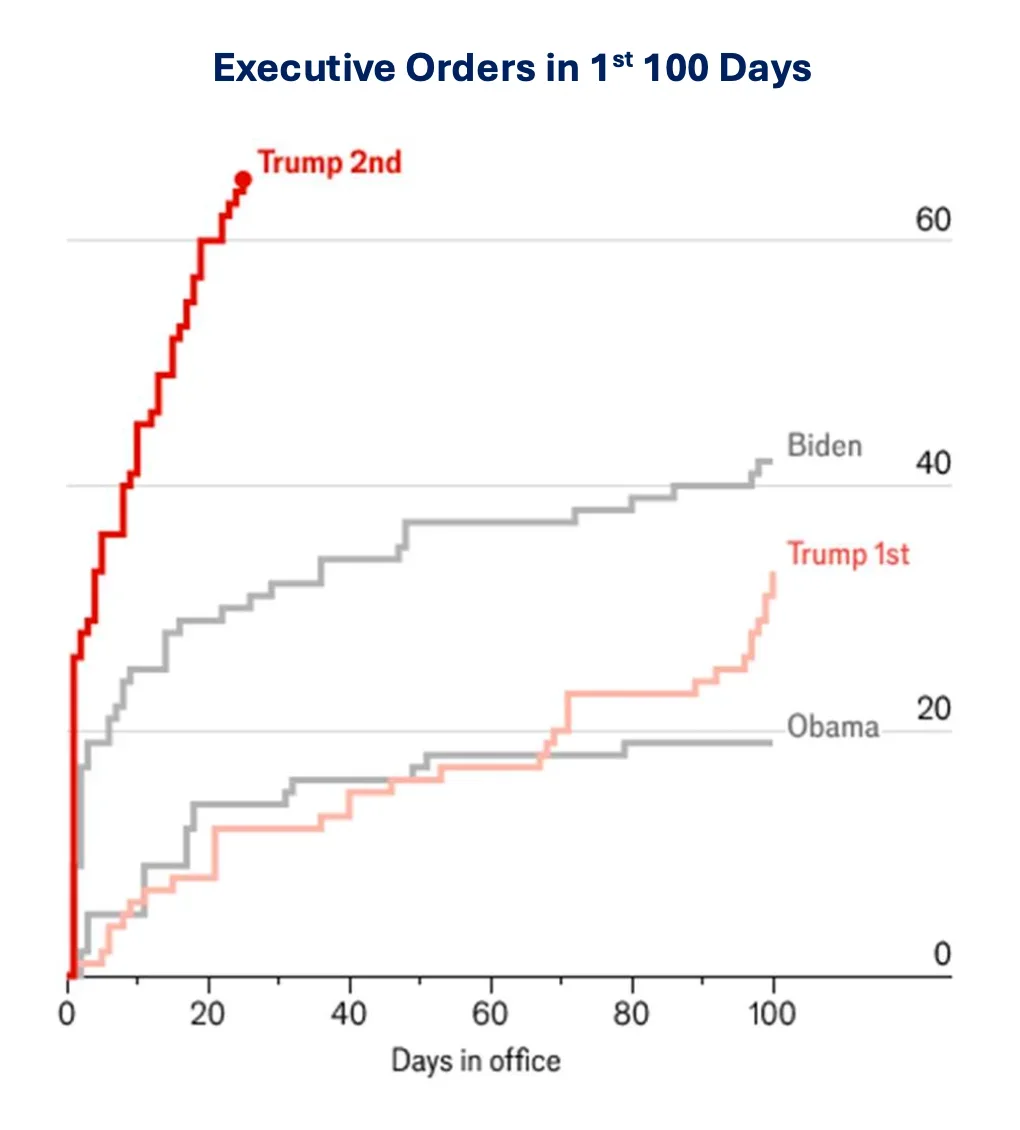

It’s been less than a month since the much-awaited changing of the guard in US Government, but the pace at which news and data has been coming to us has, at times, felt like drinking from a firehose. Table 1 shows just how unprecedented the total of executive orders signed by President Trump in the first 20 days of office is.

While it’s too early to draw conclusive considerations on the long-term effects of the new administration’s policies, we have internally singled out some trends and data points that have our utmost attention as risk managers, and which we share with you below.

TBL 1: Drinking from a firehose

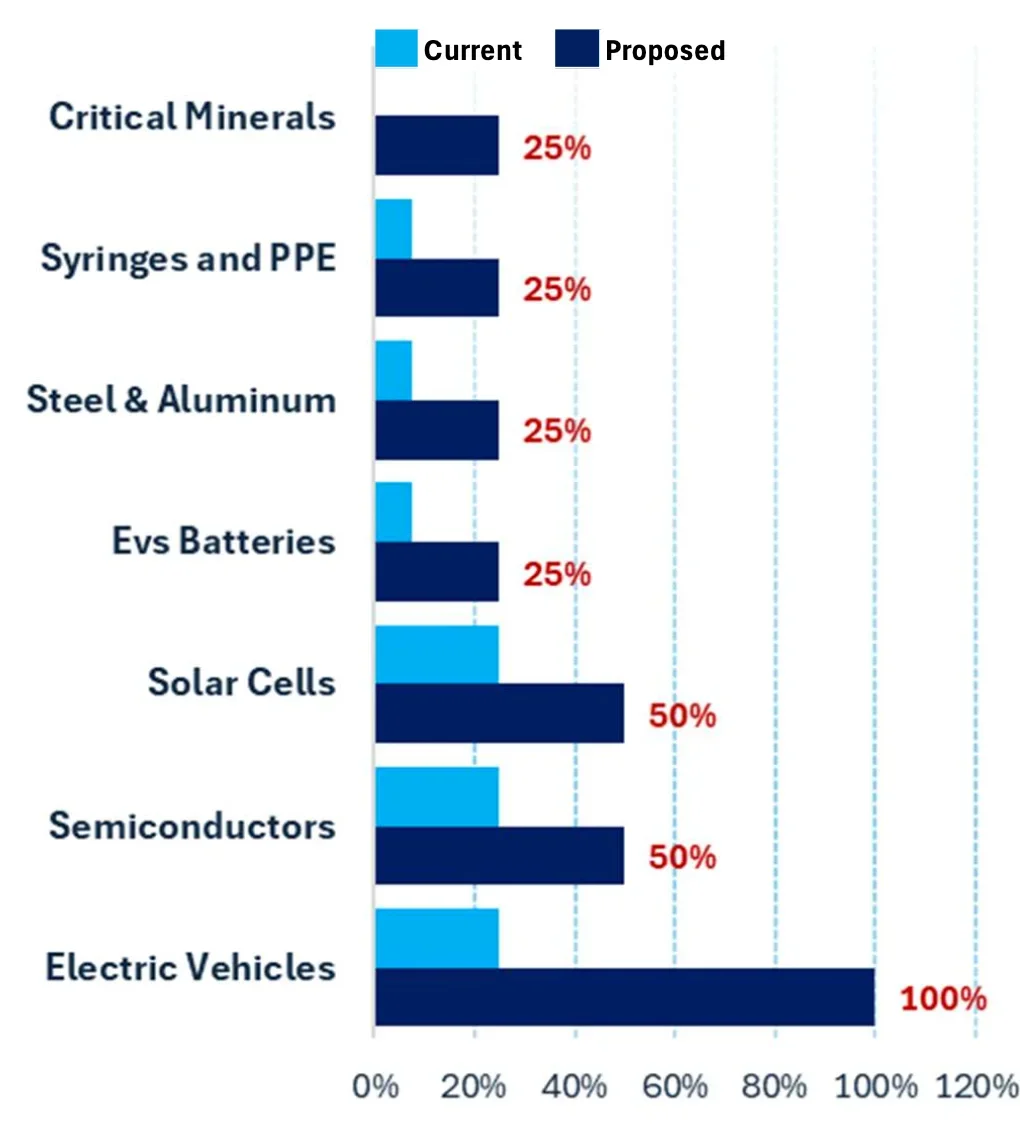

TBL 2: Proposed tariffs

PROPOSED TARIFFS: Negotiating tool or inflation driver?

Amongst the tools that the new President is committed to employ, tariffs are the one lever that market participants are watching most closely. Table 2 shows the increases in tariffs proposed under Section 301. The punitive effects of these measures will affect an estimated $300 billion of Chinese goods, and the degree to which they will add fuel to current elevated inflation readings is yet to be fully understood. The answer will greatly be determined by whether these tariffs will actually be fully enforced or if they are just the opening salvo at the negotiating table.

Upside Capture within a Store of Value Protocol.

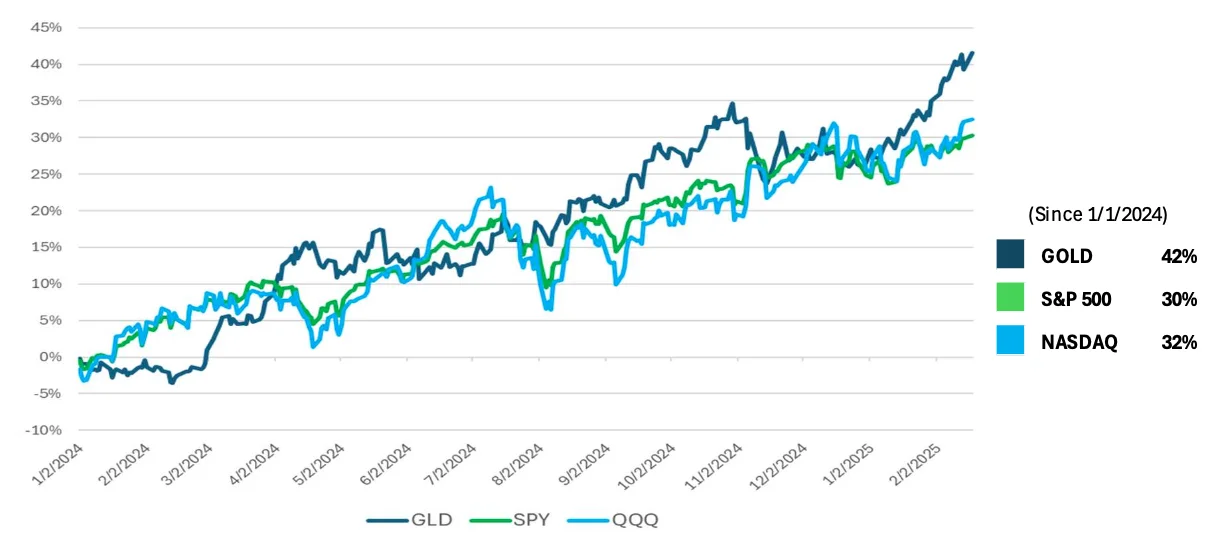

As we have often highlighted over the last two years, Modern Portfolio Theory (MPT) is the protocol we normally employ, and it is only in times of high perceived risk that we abandon our normal stance and adopt Store of Value Protocol (SoVP) to guide our allocations. SoVP does not mean risk- off; it’s simply a recognition that more things can happen than usual, as is the case this early in the tenure of a radically different administration in Washington. Accordingly, we have positioned our clients’ portfolios to benefit from uncertainty and to capture the upside via a lower exposure to risk assets. Starting in 2023, we have increased our allocations to active managers in the commodities space (which we normally shun in times of MPT) and have materially added to our overall exposure to gold, which resulted in outsized portfolio gains, for a fraction of the risk.

As Table 3 points out, while stocks grabbed most of the headlines in 2024, gold has continued to outperform US stock indices, while also offering effective downside protection.

TBL3: Gold vs. Stocks

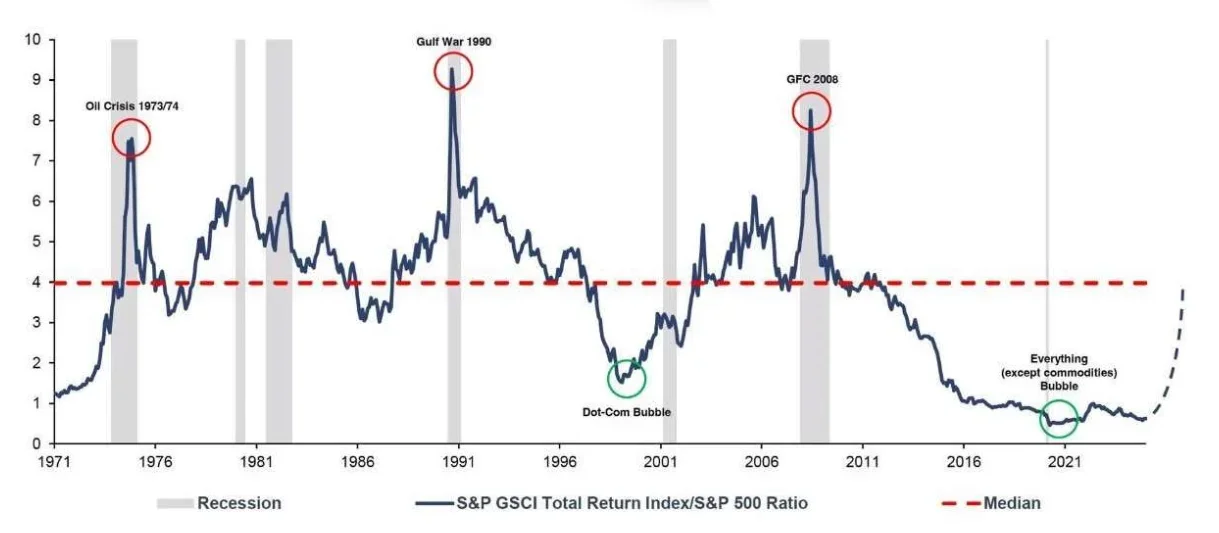

TBL4: RATIO of Gold returns to Stock Returns since 1971

(Source: Incrementum and Bloomberg LP, Feb. 2025)

Table 4 provides a longer-term perspective on how gold performs in times of economic contraction/recession. What has us on alert is the fact that even a measured reversion to the mean would signal much tougher economic conditions ahead.

Euphoria or Paradigm Shift?

It is undeniable that, despite all the perceived risks attached to the perilous fiscal and financial position of the United States, the possible inflationary pressures of a tariff-fueled deglobalized world commerce system, the effects of mass deportations on labor costs, and continued geo- political uncertainty—to name a few— the stock market has demonstrated phenomenal resilience.

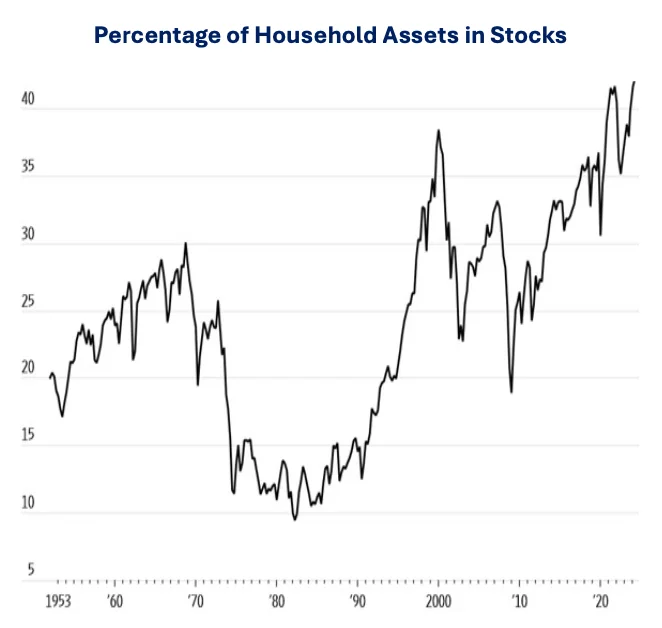

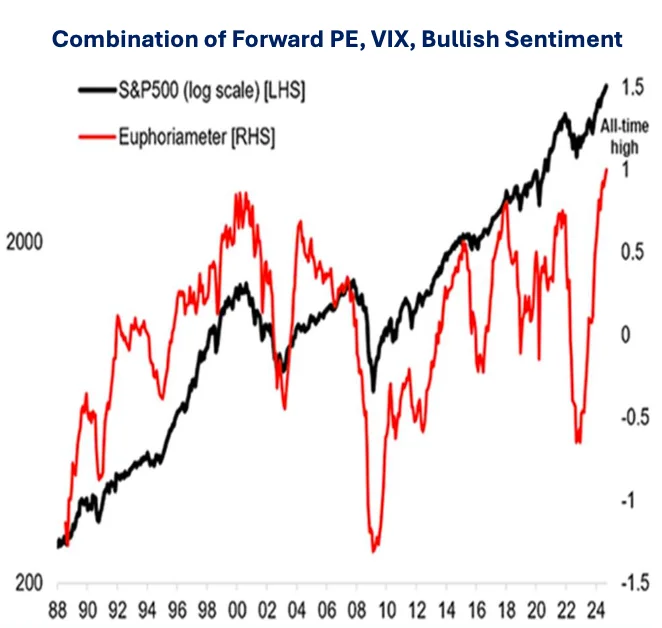

Table 5 offers an indication of market participants’ current expectations of the stock market, while Table 6 illustrates the overreliance on stocks in the average American portfolio. As risk managers, our mandate is not to tactically time the market at every turn, but rather to actively manage our clients’ portfolios to achieve the best risk-adjusted returns across economic cycles.

TBL5: Euphoriameter

TBL6: “All in, all the time”

(Source: LSEG and JP Morgan and Bloomberg LP, Dec. 2024)

We’d be remiss if we did not note that we have been impressed by the pace and scope of President Trump’s early endeavors to materially cut government spending, which, for one, have greatly contributed to the buoyancy of risk assets. However, we remain vigilant in continually assessing how the government’s cornerstone pro-growth policies (like the Tax Cuts and Jobs Act –TCJA) will measure against the need to fight sticky inflation and to curb higher borrowing costs. The speculative posture in high-beta assets, such as tech and crypto, is bound to be greatly challenged if global liquidity tightens. Therefore, we are paying particular attention to signals from the bond market, which we believe will be the ultimate, non-partisan arbiter of economic policy success.